US Nonfarm Payrolls & Currency Strength

The release of US Non-Farm Payrolls (NFP) employment data is one of the most volatile economic events. Traders worldwide eagerly anticipate this data, placing large trades based on the outcome. When employment figures significantly deviate from market expectations, it often leads to lots of volatility in Forex and other markets.

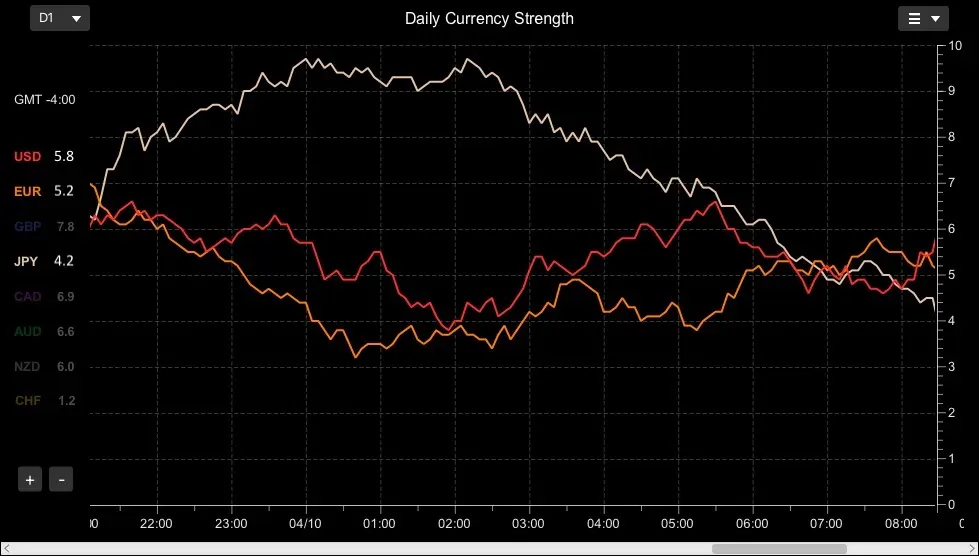

Before the US Nonfarm Payrolls news release

Below is the currency strength up to 8:20 AM ET, 10 minutes before the data release. You’ll notice that EUR, USD, and JPY currency strengths are all midrange, around 5. This suggests they are not trending i.e. ranging, which is typical in the pre-news period.

US Nonfarm Payrolls at 8:30 ET

| Release Time 8:30 (ET) | Actual | Expected | Dev |

|---|---|---|---|

| Non-Farm Employment Change | 254K | 147K | +107K |

| Unemployment Rate | 4.1% | 4.2% | -0.1% |

How to decide what Forex pair to trades.

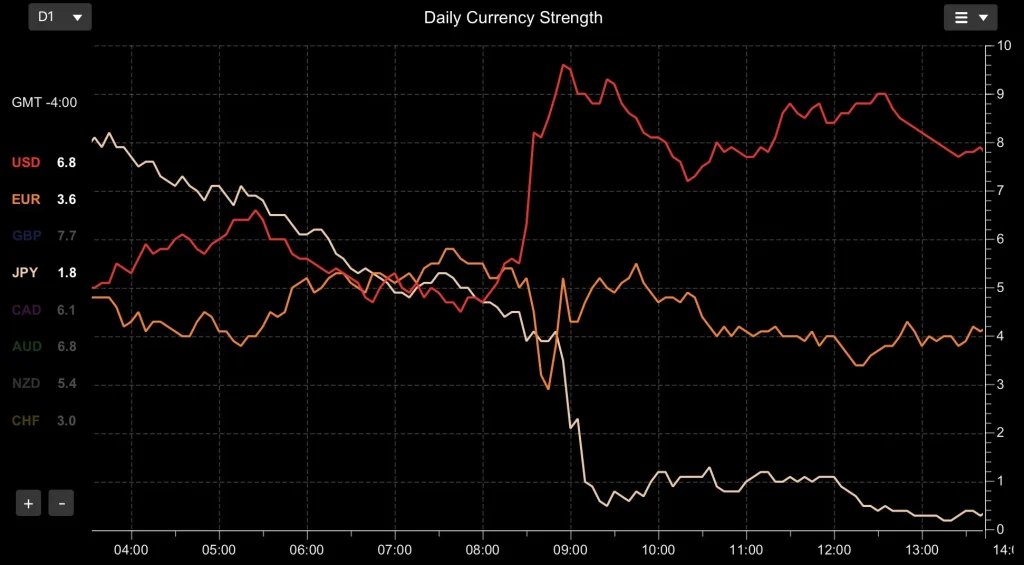

As expected, there was a sudden spike in US Dollar currency strength following the release of the NFP data. It surged to over 9, indicating a strong trend.

We can see that JPY is extremely weak, dropping below 1. In contrast, EUR is around 4-5, indicating that it is not currently trending. Therefore, the USD/JPY Forex pair would be a much better candidate to trade than EUR/USD, as both USD and JPY are showing strong trends.

Key Takeaways

- The US Nonfarm Payrolls data release generates lots of market volatility and Forex trade opportunities.

- Employment data that deviates significantly from expectation can produce large currency moves.

- When trading the USD, choose a Forex pair with a strongly trending currency moving in the opposite direction.

- Currency strength charts are essential for indentifying what currencies to trade following a volatile economic news data release.